BlockFi Login — Secure Access to Crypto-Backed Financial Services

The BlockFi login portal serves as an access point to one of the earliest and most influential platforms bridging the gap between traditional finance and cryptocurrency. Founded with the vision of creating a secure financial ecosystem around digital assets, BlockFi allowed users to earn interest, borrow funds, and trade crypto with institutional-grade safeguards. Logging in to BlockFi isn’t just a transaction; it’s a connection to a new way of thinking about wealth management in the digital age.

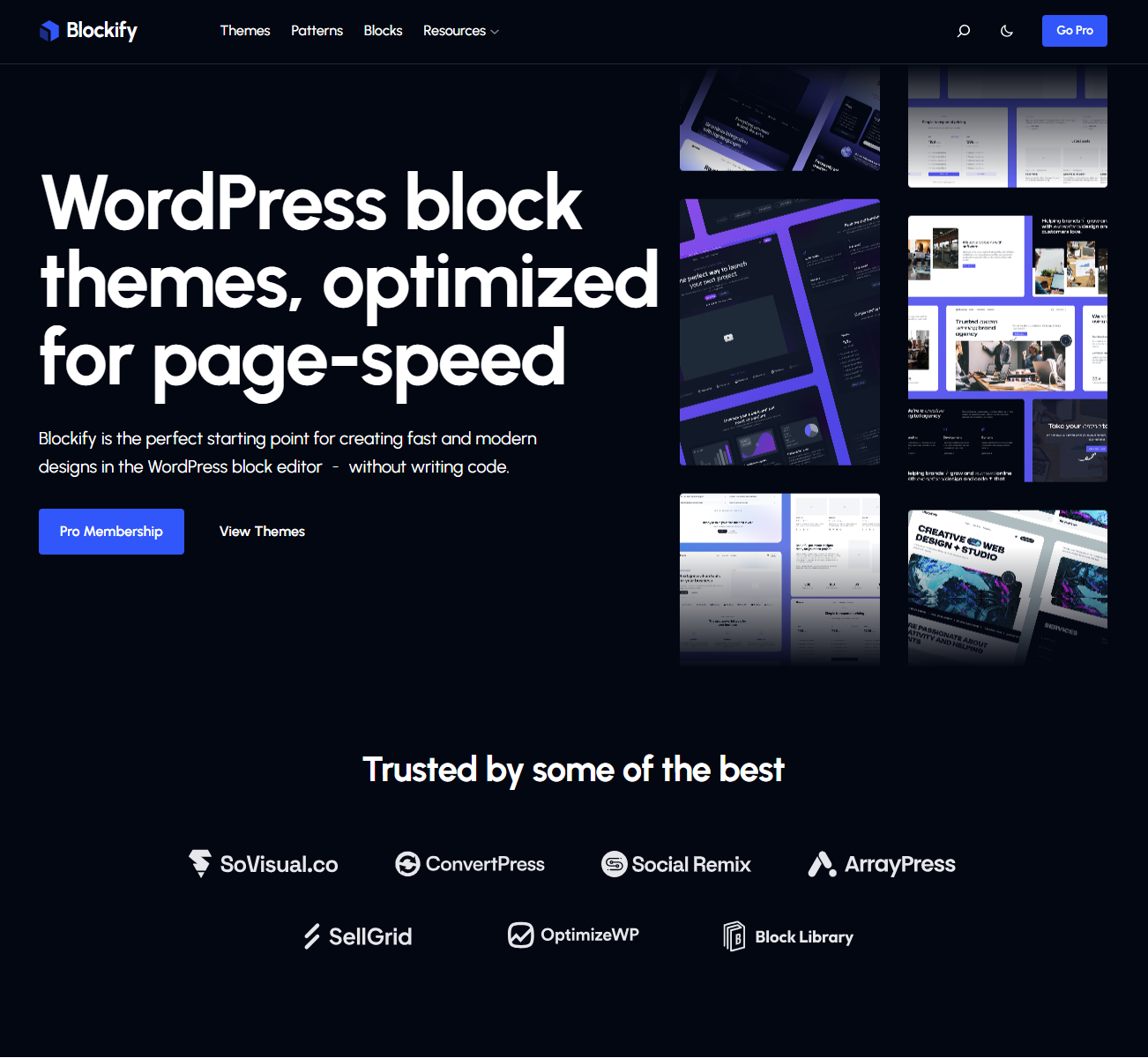

From the very first screen, the BlockFi login emphasizes trust and transparency. Whether accessed from a browser or mobile device, each element of the user interface reflects careful engineering — not only to protect user credentials but also to reassure investors that their assets are handled responsibly. The login experience captures the company’s broader philosophy: accessibility without compromise, and innovation rooted in compliance.

The Security Framework Behind Every Login

Security is the foundation of the BlockFi experience. Every login request is protected by advanced encryption protocols, two-factor authentication (2FA), and adaptive risk monitoring. When a user enters their credentials, the system immediately cross-references device data, location history, and behavioral patterns to ensure authenticity. This invisible layer of verification protects accounts from phishing, unauthorized access, and session hijacking.

The login architecture reflects BlockFi’s hybrid nature — part fintech, part blockchain infrastructure. While blockchain technology ensures decentralized transparency, BlockFi’s centralized compliance systems ensure adherence to KYC and AML regulations. Together, they form a balanced approach that merges freedom with responsibility, something rarely achieved in the volatile crypto landscape.

Designed for Simplicity and Confidence

The BlockFi login page embodies simplicity. Its minimal layout and consistent design language provide a sense of calm in a market often marked by volatility. No unnecessary distractions, no hidden steps — just clear, direct access. This clarity extends to the entire user experience: from authentication to portfolio management, the platform ensures every user feels in control.

Beyond design, this simplicity also reflects a strategic decision. By removing friction points and emphasizing transparency, BlockFi sought to redefine how people perceive crypto platforms. Logging in doesn’t feel like entering a high-risk experiment; it feels like checking your balance at a regulated financial institution — one that speaks the language of both crypto and compliance.

From Login to Lending: A Financial Ecosystem

Once authenticated, users gained access to a suite of services that blended crypto with traditional financial tools. They could earn interest on holdings, secure USD loans using Bitcoin or Ethereum as collateral, and trade digital assets seamlessly within the same interface. This holistic ecosystem reimagined what logging into a financial account could mean — not just viewing balances, but managing wealth across decentralized and centralized systems in one place.

Each feature of the platform reinforced BlockFi’s core principle: your crypto can do more. The login was merely the first step into a world where digital assets weren’t just stored but worked actively for the user. That sense of empowerment is what defined the BlockFi experience and attracted investors across experience levels.

Trust Through Transparency

For users, the BlockFi login wasn’t only about personal access — it was also about verifying that the institution itself could be trusted. The company frequently emphasized transparency in operations, publishing reports and compliance updates to ensure users understood where their assets were held and how the system functioned. Each login, therefore, was backed by a visible framework of responsibility.

The user dashboard, accessible after login, offered complete visibility: interest accrual rates, collateral metrics, and loan terms displayed clearly. This transparency extended into communications as well — from security notifications to product updates, every message was aligned with the company’s commitment to clarity and user education.

The Role of Technology in Secure Access

At its core, BlockFi’s login infrastructure combined blockchain technology with conventional security layers. Blockchain ensured transparency and auditability, while traditional encryption protocols ensured compliance with financial laws. This blend created a unique login experience — one that borrowed the best of both worlds.

Advanced session management, secure cookies, and behavioral analytics worked together to create a seamless yet safe entry for each user. Even in the event of attempted breaches, redundant verification systems stood ready to isolate and contain threats. The result was an authentication process that felt effortless yet carried the sophistication of institutional cybersecurity frameworks.

Lessons From a Changing Landscape

Over time, the BlockFi story has become a broader lesson in the evolution of crypto-finance. The login page — once a simple access point — now represents a historical marker of how rapidly this industry grew. The platform’s journey reminds users that innovation and risk often travel together, and that every click to “log in” is also an act of trust in a constantly evolving ecosystem.

While the company faced regulatory challenges and market turbulence, the design and intent behind its user access systems remain examples of thoughtful fintech engineering. Even as the crypto sector learns from these experiences, the principles established by BlockFi’s early login architecture — transparency, usability, and security — continue to influence how new platforms are built.

The Future of Digital Financial Access

Looking ahead, the concept of logging into a crypto account will continue to evolve. Decentralized identity, biometric verification, and multi-chain authentication are shaping what secure access will mean in the next decade. The vision pioneered by BlockFi — merging traditional stability with digital innovation — remains central to that evolution.

Whether users are managing tokens, loans, or yield strategies, the spirit behind every login remains the same: control, security, and empowerment. As blockchain technology matures, the lessons of platforms like BlockFi continue to inspire the next wave of secure, user-first financial applications.